The State of Reputation: Overview of Reviews in the Coffee and Dessert Sector is a first-of-its-kind survey in Brazil, conducted by Harmo. We collected and analyzed more than 160,000 reviews published in 2023, from more than 4,000 locations across 46 chains, listed on Google Business Profile.

Reviews express the experiences and opinions of these companies' customers, both quantitatively and qualitatively. Furthermore, reviews play a fundamental role in consumers' decision-making processes .

The report offers a detailed overview of these establishments' online reputation, based on the voices of their own customers. Our goal is to provide the market with the first industry benchmarking based on public reviews, allowing companies to compare their performance, identify opportunities for improvement, and strengthen their business strategies.

We hope that managers, entrepreneurs, professionals, and organizations in the sector can use this material to transform their businesses, promoting increasingly appropriate and personalized experiences for their customers and partners.

This report is an essential tool for understanding the current market, identifying opportunities for improvement, and strengthening the online presence of companies in the sector by considering the opinions of those who matter most: the customer.

Brands analyzed

We analyzed 46 chains, divided into four categories: açaí bowls, coffee shops, dessert bars, and ice cream shops. The majority of reviews came from the South and Southeast regions, accounting for almost 85% of the reviews, with a balanced distribution between men (50.7%) and women (49.3%).

Report Demographics

The Southeast region has the largest number of locations, representing 59% of the total, followed by the South (20%), Northeast (9%), Central-West (8%) and North (3%) regions.

Despite representing only 20% of the total number of locations, the South region stands out for the number of reviews, accounting for 27% of the total. Notably, the three Southern states have the highest average number of reviews per location, with 48.3 reviews per store, compared to 35 reviews per store in the Southeast.

The states of the Central-West have the highest proportion of assessments with text (48.4%), followed by the Southeast (45.8%), North (41.9%), Northeast (41.7%) and South (37.5%) regions.

Together, the Southeast and South regions represent approximately 80% of all locations and 84.6% of the review volume. The Southeast contributes 49.5% of review responses in Brazil, while the South contributes 37.4%. However, when analyzing the responses within each region, the Southeast responds to 25.8% of its reviews, while the South responds to 41.2% of customer comments.

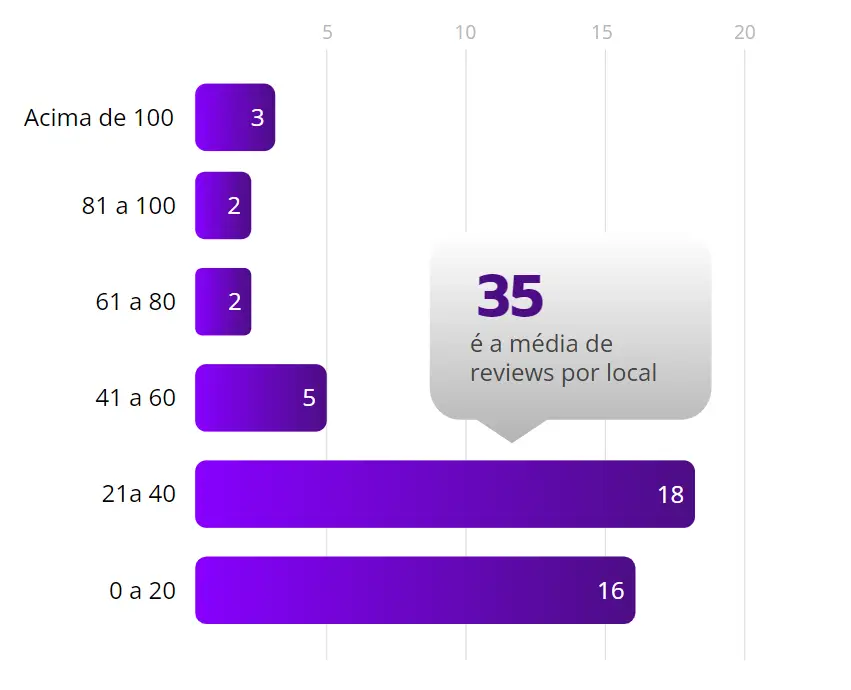

Average Reviews by Location

The average number of reviews received per location was just 35, meaning each location received, on average, just one review every 10 days. Of the 46 businesses analyzed, only three received more than 100 reviews per location in 2023, which is considered low given the high volume of consumers who pass through their stores daily.

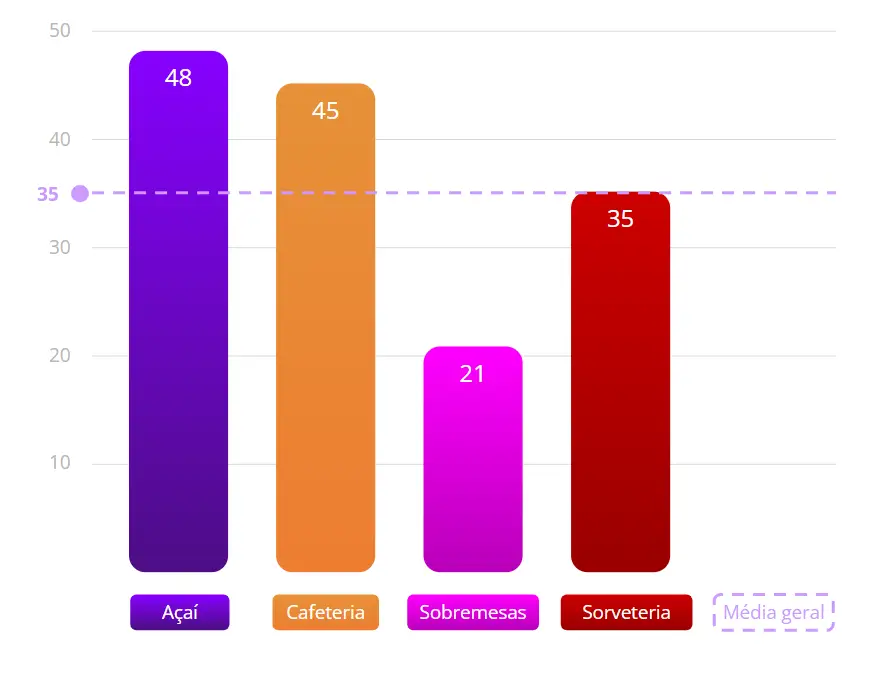

Average Reviews per Location by Category

Among the categories analyzed, açaí stands out with the best average number of reviews per location, at 48, while the dessert category has the lowest average, with only 21 reviews per location.

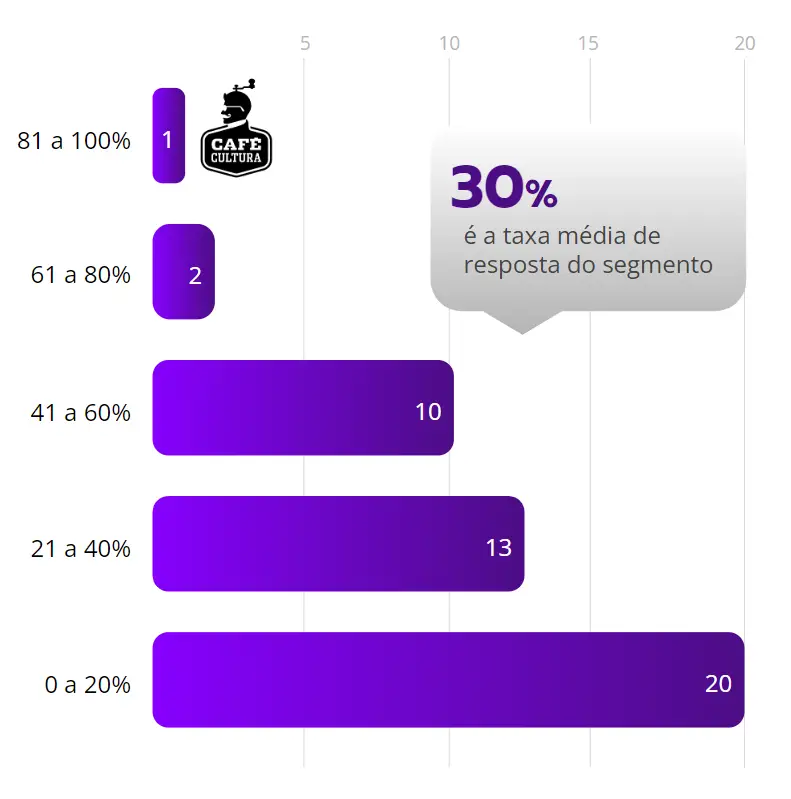

Response Rate

The average response rate was 30%, with only one brand achieving the ideal response rate above 80% (Café Cultura).

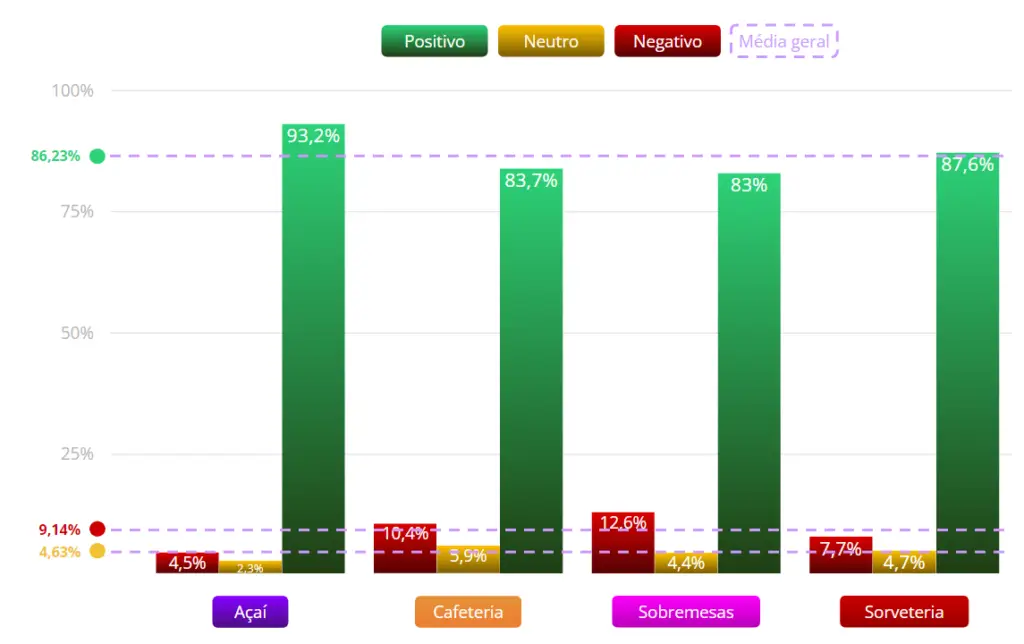

Sentiment Rate

Reviews were categorized as positive, neutral, and negative. The segment average showed 86.2% positive reviews, 4.6% neutral, and 9.1% negative. The category with the highest positive rate was Açaí, with 93.2% positive reviews. And the category with the highest negative rate was Desserts, with 12.64% negative reviews.

General Segment Note

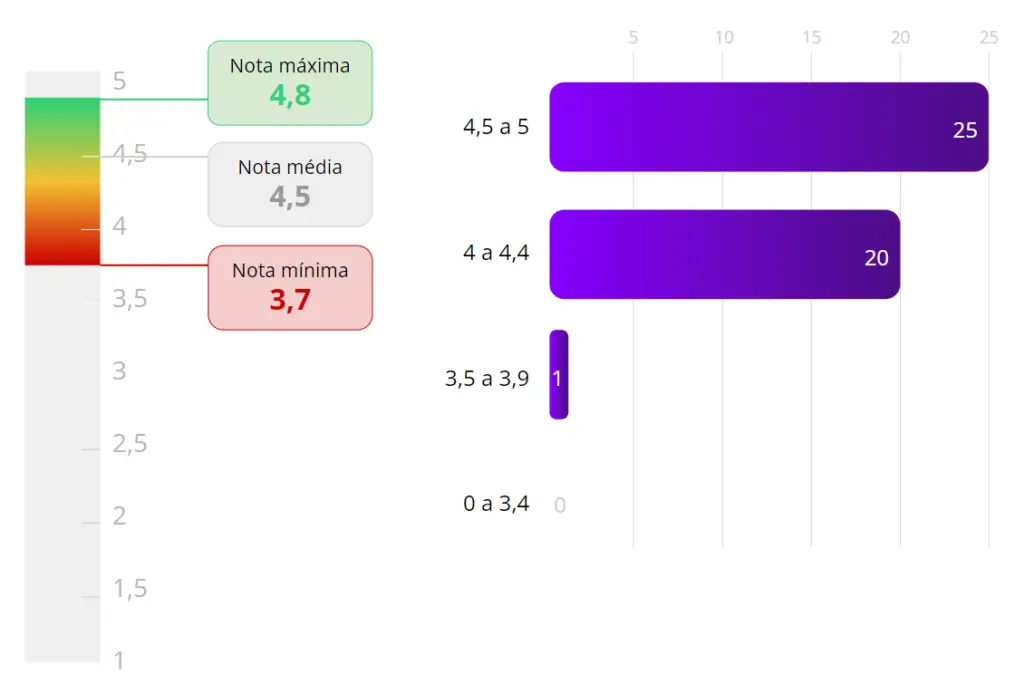

The average score of the brands analyzed was 4.5, which represents a zone of excellence and a high level of competition among companies in this sector.

Conclusion

The study reveals that the coffee and dessert sector is experiencing rapid growth , driven by the solid reputation of brands, reflected in an overall rating of 4.5 stars . This scenario is essential for the sector's economic performance, considering that 92% of consumers would only visit businesses with at least four stars, according to Exploding Topics .

The economic impact is also notable. Between 2019 and 2022, the number of açaí franchises in Brazil grew 200%, with significant expansion in the number of establishments and revenue, according to the ABF ( Brazilian Association of Brazilian Associations). This demonstrates the correlation between a good reputation and economic growth: brands that prioritize quality and satisfaction attract more customers and ensure loyalty.

Categories like ice cream and açaí stand out even more, with average ratings of 4.6 and 4.7 stars, respectively. These ratings not only indicate excellent quality and service, but also translate into higher visit frequency and increased business volume. Even the coffee and dessert categories, with ratings of 4.4 and 4.5, have the opportunity to enhance their reputation by leveraging consumer feedback to continually improve their services.

Furthermore, 85% of consumers leave reviews to help others or businesses, making feedback essential for improving operations. Actively managing responses is crucial: 88% of consumers prefer companies that respond to all reviews, which can improve sales and loyalty.

In short, brands that understand the importance of a solid online reputation and actively work to improve the customer experience are better positioned to grow, both in terms of number of locations and revenue. The connection between reputation and growth is not just a trend, but a reality that is shaping the future of many retail companies.

Harmo Cases from participating brands