Brazilian consumer behavior in the foodservice sector is changing, and understanding this dynamic is essential for the competitiveness of bars and restaurants.

The State of Reputation 2023 report : Overview of Reviews in the Bar and Restaurant Sector , the result of a partnership between Harmo and Abrasel , presents an unprecedented survey of 279,317 reviews on Google Business Profile, published between January 2023 and September 2024.

This study not only maps customer perceptions but also contextualizes how these opinions shape purchasing decisions and business strategies in the segment.

We hope that managers, entrepreneurs, professionals, and organizations in the sector can use this material to transform their businesses, promoting increasingly appropriate and personalized experiences for their customers and partners.

Throughout this material, we'll explore the report's key data, offering an unprecedented benchmark for the industry, designed primarily for leaders and managers seeking to transform their online reputation into a strategic asset.

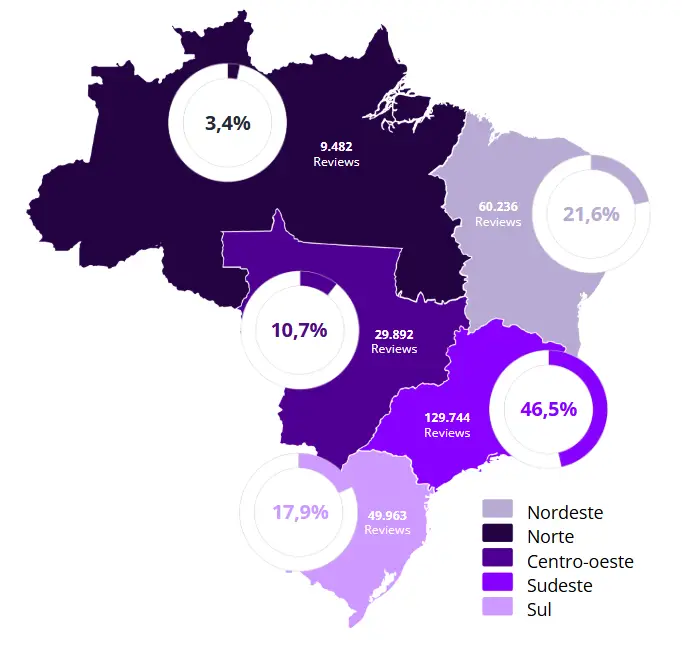

Demographic data

The networks selected for the study have a greater presence in the Southeast (46.5%), Northeast (21.6%) and South (17.9%) regions, which is reflected in the high volume of reviews in these areas, representing more than 85% of the total .

The proportion of reviews written by men and women is divided as follows: 55% were written by men and 45% by women.

Gender classification is carried out using artificial intelligence, which identifies users based on their Google names.

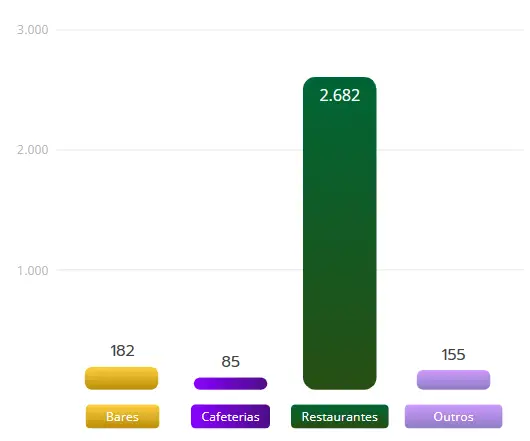

Locations analyzed

The sample of analyzed locations, composed of ABRASEL members, reveals a clear predominance of the Restaurants , with 2,682 establishments evaluated, representing the largest portion of the study. Next comes Bars Other category with 155, and finally, Coffee Shops with 85 reviews.

This difference in the volume of reviews highlights the representativeness of the Restaurant category, which concentrates most of the data analyzed .

Still, the 12.4% sample of ABRASEL members offers a reliable view of the sector, allowing for valuable analysis, even when focusing on a specific portion of brands.

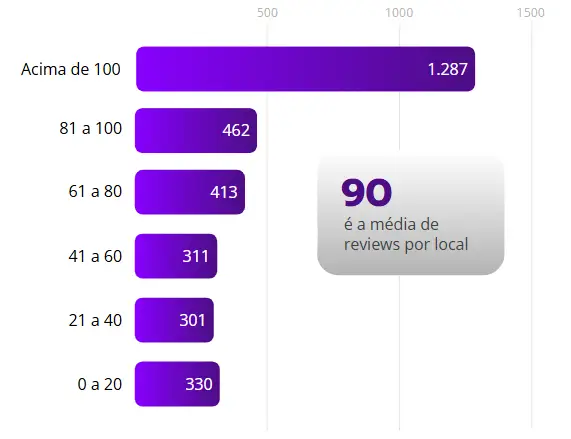

Average reviews by location

The average number of reviews received per location in the period 23/24 was 90. Of the 3,104 locations analyzed, around 40% received more than 100 reviews per store, and 60% received less than that – which is considered low, given the high flow of consumers that pass through the stores daily.

It's important to note that reviews serve as social proof ; the more reviews a company receives, the more trustworthy it becomes in the eyes of consumers. At this point, we can say that the sites analyzed are, for the most part, less than ideal.

Therefore, there is a clear opportunity for brands to increase the number of reviews and, consequently, improve their online reputation and customer engagement.

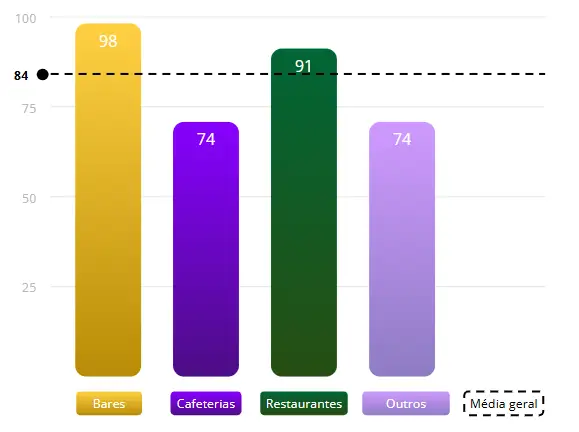

Average reviews by category

coffee shops and others category , with only 74 reviews. On the other hand, the bars category stands out with the highest average , reaching 98 reviews per location.

Here lies the first major opportunity for the sector. Increasing the volume of reviews on Google is essential for a brand's reputation, as it improves visibility and instills trust in consumers.

According to a study, 90% of consumers read online reviews before visiting a physical store , and 76% say they read these reviews regularly or always before making a purchase decision. This reinforces the significant impact of reviews on the decision to visit a physical location.

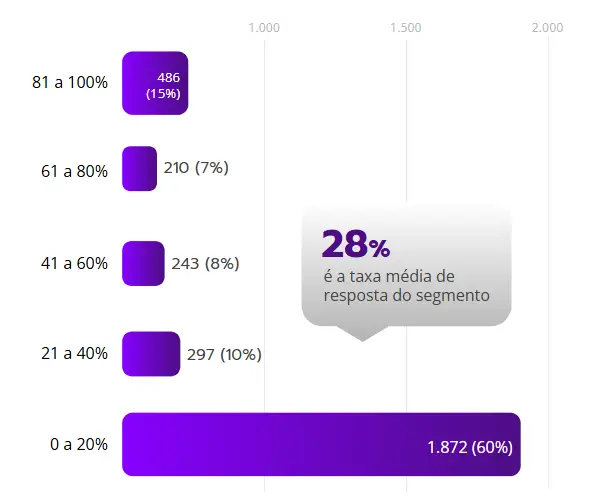

Overall response rate

The low average response rate to reviews in the bar and restaurant sector, currently at 28% , highlights the industry's second major opportunity . The vast majority of brands haven't achieved the ideal response rate, which is above 80% , highlighting the importance of adopting this practice.

Responding to customers is a simple action , but it has a great impact, as it shows that the establishment values the opinion of consumers , generating a positive effect on the perception of other potential customers who search for information about the company on Google.

Studies show that interacting with reviews, especially negative ones, can change perceptions and directly influence purchasing decisions. This is an aspect that deserves special attention from the industry, since, according to the 2024 Local Consumer Review Survey , 88% of consumers say they prefer to do business with companies that respond to all reviews .

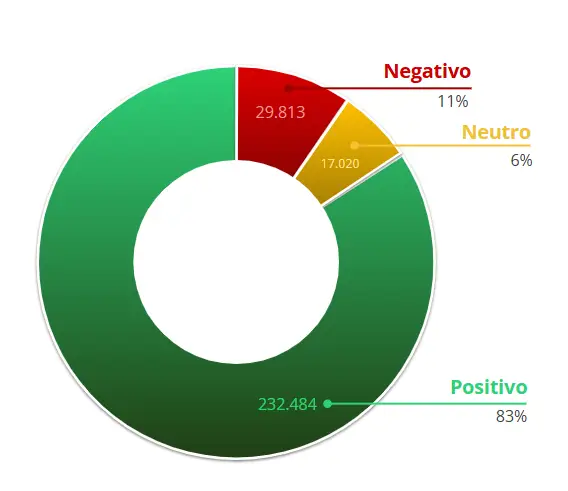

Overall sentiment rate

The graph represents the sentiment rating of reviews according to the number of stars given by consumers. We categorize 1- and 2-star reviews as negative, 3-star reviews as neutral, and 4- and 5-star reviews as positive. This categorization is the global standard for this popular metric that reflects public customer opinion.

The sentiment index based on the reviews collected in the study shows that 83% of reviews are positive, 6% are neutral, and 11% are negative. The proportion of negative reviews in the industry is above the ideal of 5%.

Focusing on reducing negative reviews increases positive customer perception and impacts your business's organic ranking in local searches. And there's only one way to reduce negative reviews: provide excellent customer service and earn more positive reviews.

These actions will not only increase review volume but will also have a direct impact on organic rankings in local searches.

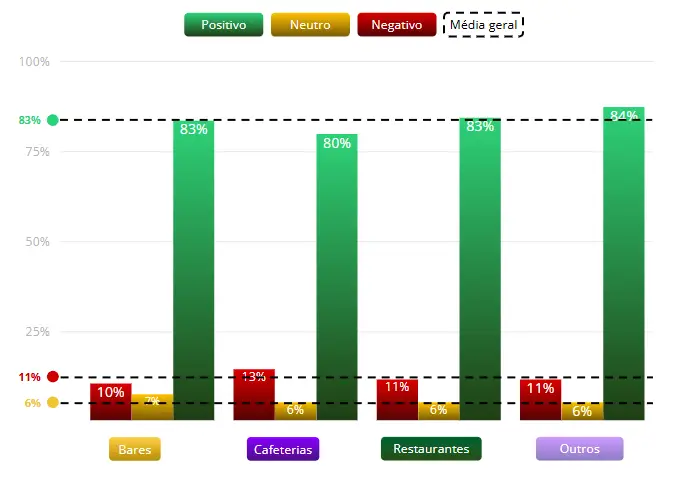

Sentiment rate by category

small variation in positive reviews is observed , which range between 80% and 84%. However, in the case of negative reviews, coffee shops stand out negatively, with 13% of unfavorable reviews, while the other categories maintain an average rate of 11%. It is important to note that the bars category performed below average in all three sentiment indicators, while restaurants and other categories outperformed the same indicators.

Textual analysis

The results of this analysis were generated by artificial intelligence, which categorizes the text and assigns the sentiment to the customers' verbalization.

Of the more than 279,317 public reviews analyzed in 2023 and 2024, 48.7% contained a comment describing the experience with the establishment.

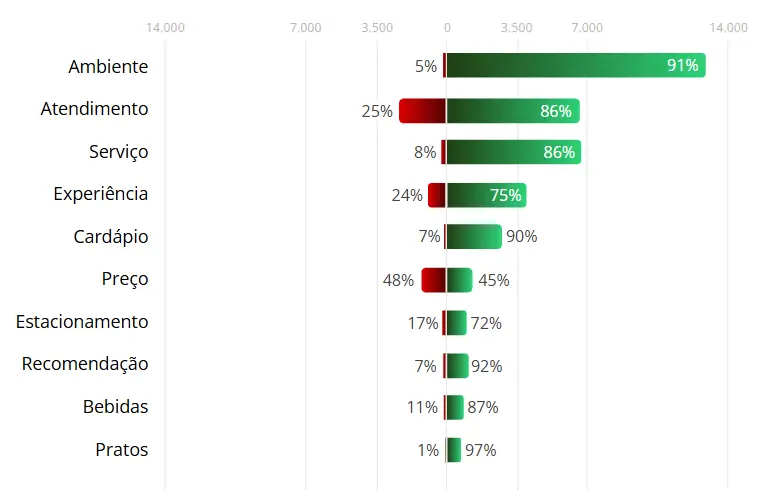

The graph below shows the topics most discussed by consumers and consumer sentiment regarding them. A general summary of the topics is provided on the next page.

Negative summary

According to the negative reviews analyzed, the main problems faced by the brands analyzed include:

- Service is often criticized for being slow, disorganized and sometimes rude ;

- Inconsistent food quality , with reports of poorly prepared and flavorless dishes;

- Prices are considered high in relation to the quality offered, generating dissatisfaction regarding cost vs benefit ;

- Environments with excessive noise ;

- Lack of options for specific diets;

- Many customers express disappointment and reluctance to return to establishments.

Positive summary

Overall, these establishments provide satisfying dining experiences, combining good food, quality service, and pleasant surroundings, catering to different tastes and occasions.

The following stand out:

- Quality food , with varied and tasty dishes, catering to different culinary preferences.

- The service is often praised as attentive and efficient .

- The environments are described as welcoming and pleasant , suitable for various occasions.

- Facilities such as parking .

- Some establishments stand out for their unique features, such as panoramic views, options for specific diets and live music .

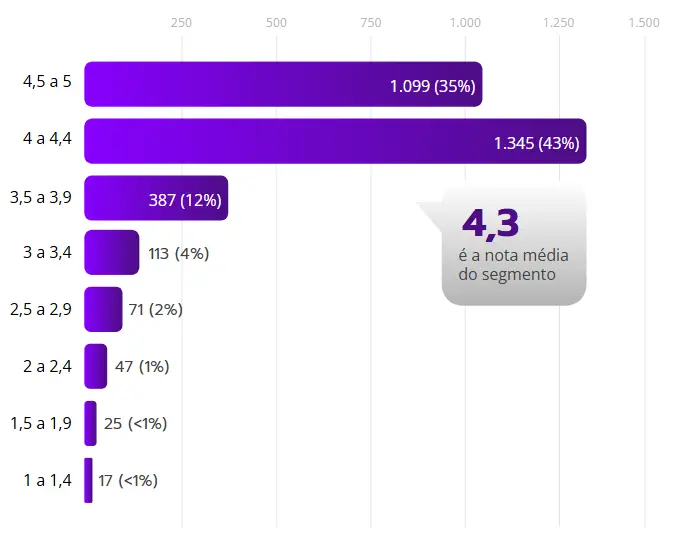

General segment note

During this period, the average rating for brands analyzed in the sector was 4.3 stars on Google, close to excellence, which starts above 4.5.

Analysis of the reviews reveals that 1,559 locations (50%) exceeded the industry average , achieving scores above 4.3 , while the remaining 50% were at or below average. According to the study, 92% of consumers consider buying only from companies with 4-star ratings or higher, and in the current survey, 50% of brands achieved this minimum rating.

However, it's important to note that 160 properties fell below a 3-star rating. Recent data shows that customer confidence drops dramatically by 67% when a rating drops from 4 to 3 stars.

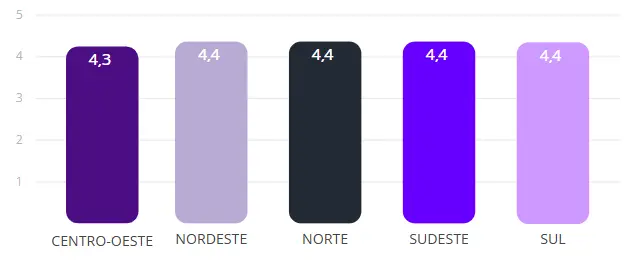

Segment rating by category and region

Although the variation in scores between categories is small , it is worth noting that bars and coffee shops have an average of 4.2 and 4.2 , while restaurants and other restaurants achieve 4.4 . This slight difference suggests a relatively uniform perception of quality across categories, with a minimal margin of variation.

This consistent behavior is also reflected in the regional analysis, as illustrated in the accompanying graph, which may indicate that consumer expectations regarding experience and service are similar, regardless of location or type of establishment. This uniformity highlights the importance of maintaining high standards across the board , as small improvements can be decisive in outperforming the competition and achieving excellence in any segment.

Conclusion

The study revealed strategic data for understanding the performance of Abrasel's associated bars and restaurants in the digital environment, especially on Google. The restaurant category, the most representative in the study , excelled in indicators such as average rating, review volume, and response rate . This data shows that restaurants are increasingly aware of the importance of managing their online reputation, understanding the direct impact of responding to reviews on attracting and retaining customers .

From a broader perspective, the bar and restaurant market is experiencing steady growth . According to Abrasel , the sector's revenue is expected to reach R$428 billion by the end of 2024 3.3% increase over the previous year. This growth reflects the recovery in household consumption, which increased 1.5% in the first quarter of 2024, outpacing overall GDP growth. Furthermore, a study by Abrasel in partnership with Stone revealed a 5.2% increase in bar and restaurant traffic in March compared to the previous month, highlighting the sector's dynamism.

This scenario highlights the importance of active online reputation management as a competitive differentiator. Companies that regularly respond to reviews attract more customers , consolidate a positive digital presence, and directly influence purchasing decisions. According to a study , 4 out of 5 consumers change their minds after reading a negative online review, highlighting the impact of reviews on the purchasing and decision-making journey.

Furthermore, research shows that 50% of consumers who research online visit a physical store within 24 hours, and the average purchase value in physical stores is 20% higher than in online stores, according to Forrester. This data reinforces the importance of maintaining optimized digital profiles and responding to reviews to maximize customer conversion potential.

This information shows that the industry is evolving toward a more digital model focused on customer experience. Companies that recognize Google as a strategic customer acquisition channel will have a significant advantage, given that 82% of consumers research online before visiting a physical store.